shame and self-judgment when it comes to your past or current savings habits. Shame is like kryptonite to your financial health because it’s one of the most painful emotions. Since we are programmed as human beings to avoid pain, we may avoid looking at anything that triggers shame, including learning from past mistakes, taking charge of current savings habits or creating a savings plan for financial security.

shame and self-judgment when it comes to your past or current savings habits. Shame is like kryptonite to your financial health because it’s one of the most painful emotions. Since we are programmed as human beings to avoid pain, we may avoid looking at anything that triggers shame, including learning from past mistakes, taking charge of current savings habits or creating a savings plan for financial security.Let’s begin shining the light on any shame we have around saving money to create a more positive mindset and optimize financial flow.

Understanding Emotional Components of Savings

Just hearing the word savings can evoke various emotions. What comes up for you as you read the following questions.

- What attitude did those who raised you have about saving money? Did anyone explain to you in a helpful, non-judgmental way the importance of savings?

- How old were you when you first started saving money?

- What happened to that money you saved as a younger person? Is it included in your current financial nest egg? Did someone take it? Did you use it to support the household you were living in? Did you spend it? If so, on what? On yourself or others?

- Do you notice any resentment toward anyone who acted against your well-being around savings? Is there any self-judgment or self-resentment?

Now that you’ve reflected on some of the earliest aspects of your relationship with money and savings, consider how these experiences may have set the stage for how you approach saving money today.

Recognizing Shame and Self-Judgment:

It’s common for people to hold onto self-judgment, self-resentment or shame when it comes to their savings. These negative emotions can hinder our ability to save more effectively. Ask yourself:

yourself:

- Is there any part of me that is holding onto self-judgment, self-resentment or shame when it comes to how much money I’ve saved at this stage in my life?

- Is there something I’m holding against myself that is blocking my ability to save more? If so, is there a part of me that believes it serves me to hold on to this belief?

Letting Go and Cultivate Compassion to Create Financial Flow

To overcome shame and self-judgment related to savings, it’s crucial to develop self-compassion and let go of negative emotions. When you let go of the negative judgment, you make room for positive, consistent action. Imagine the possibilities if you could let go of self-judgment and have compassion for yourself regarding your savings. What money-saving actions could you take if negative self-judgment did not weigh you down?

To overcome shame and self-judgment related to savings, it’s crucial to develop self-compassion and let go of negative emotions. When you let go of the negative judgment, you make room for positive, consistent action. Imagine the possibilities if you could let go of self-judgment and have compassion for yourself regarding your savings. What money-saving actions could you take if negative self-judgment did not weigh you down?

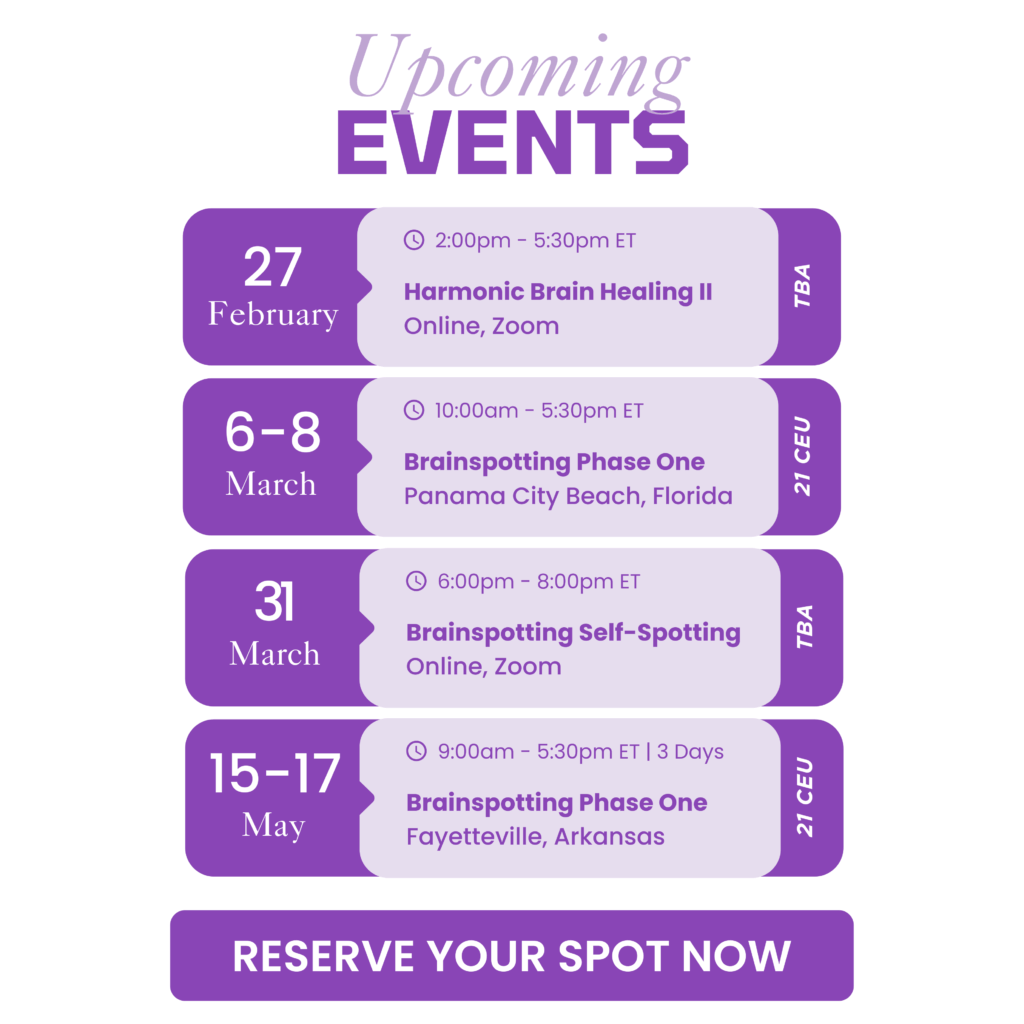

In Optimizing Your Savings, we use a brain-wise, focused mindfulness called Self-BrainSpotting to release these feelings and open up to self-compassion, take positive action toward saving money and shift into abundant possibilities.

If you want to expand your connection to saving money and your financial well-being, connect with us at hello@financialflow.co, and/or join us July 24 for Optimize Your Savings. Let’s explore creating healthier financial habits together. Remember, it’s never too late to start anew and improve your savings habits. Embrace the joy of saving, overcome shame and pave the way for a brighter financial future.